Join Our Live Chat with Tim Gwynn Jones

On the excellent series The Chair: In the Room at the Fed

On Monday, May 19th at 1PM EDT, editor Caleb Zakarin will speak live on Substack with Tim Gwynn Jones about his incredible eight-part series, The Chair: In the Room at the Fed. Tim is a lead policy analyst at Medley Advisors and an expert on the European Central Bank. In The Chair, he turns his attention to the ECB’s American counterpart, the Federal Reserve (“The Fed”). Each episode in the series focuses on the life, career, and views of the chairperson, the central bank’s leader. The Fed chair wields power rivaling that of the US president, controlling the levers to create a recession or stave off a depression. Whenever there is a financial crisis, the chair suddenly becomes the most popular person in Washington.

To join our discussion and ask Tim questions live, add our event to your calendar.

Register your interest for the live event here.

Tim has provided two guides on the series, which you can read here:

Some commentary from NBN editor Caleb Zakarin:

The Federal Reserve is not only one of the United States’ most important institutions, it is one of the world’s most consequential. As America’s central bank, the Fed controls monetary policy and is tasked with defending the dollar’s integrity. The US dollar (and dollar-denominated debt) dominates the world. It’s used in most foreign exchange transactions and held in reserves at eye-watering quantities. This gives the Fed chair incredible power on a global scale.

The IMF’s former chief economist Kenneth Rogoff recently published Our Dollar, Your Problem, a book examining the global role of the US dollar. The dollar has held a dominant position, without much competition, since the Bretton Woods agreement of 1944 pegged the dollar to gold and almost all other currencies to the dollar. Our Dollar, Your Problem borrows its title from a quip made by Richard Nixon’s Treasury Secretary John Connally to European leaders at a meeting in Rome, after Nixon infamously ended dollar-gold convertibility, effectively floating the currency. The Europeans, who held significant stores of Treasury bonds, were frightened that Nixon’s actions would send US inflation skyrocketing, effectively wiping out their reserves. When the US sets fiscal and monetary policy, the ripples in the global economy can come crashing like tsunami waves.

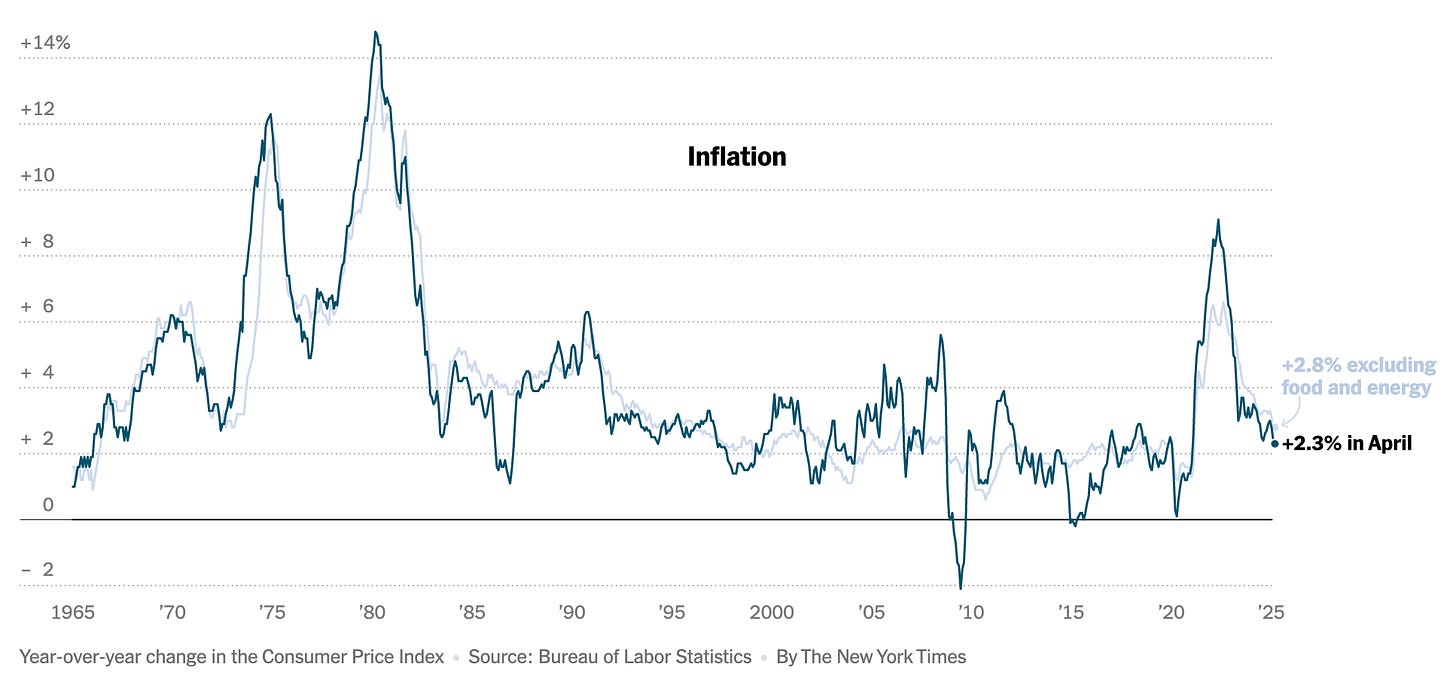

Not long after, the Fed, especially under the leadership of chairman Paul Volcker, asserted itself as the tamer of inflation and the ultimate defender of the global (fiat) dollar-based system. This arrangement carries with it an exorbitant privilege, allowing the US to borrow at low costs, run large trade deficits, and influence other countries holding Treasury reserves. From the mid-1980s until the post-Covid inflation spike, the dollar has remained relatively stable. Of course, there have been multiple financial crises along the way, but the dollar has remained the key currency.

That might all be changing, particularly as the independence of the Federal Reserve comes under threat. The Fed’s history provides the context for understanding our day’s challenges and the dollar’s future. If the dollar loses its luster, the ramifications will be astonishing, though not unprecedented. As Rogoff explains, we’ve gone through numerous key currencies before: the 16th century saw the Spanish dollar, the Dutch guilder ruled in the 17th century, the 18th and 19th centuries were dominated by the British pound, and since World War II the US dollar has been the leader of the pack. No one knows what will happen next, but history is often a helpful guide.

Featuring interviews with many of the world’s most knowledgeable journalists and scholars like Nick Timiraos, Chief Economics Correspondent at The Wall Street Journal, and Sebastian Mallaby, Paul A. Volcker Senior Fellow for International Economics at the Council on Foreign Relations, The Chair is the perfect entry point to understanding the historical context of the US dollar.

Listening to people talking is a slow process compared to reading. Substack is diluting the intense experience they offered. Listening to two people talking about a book on NBN according to an established format condenses and introduces the book - this podcast is not doing that. Will transcripts be available?